vermont state tax form

Retiree Direct Deposit Form Retiree Direct Deposit Form. The W-2 form reports an employees annual wages and the amount of taxes withheld from his or her paycheck.

The article number or location in the tax treaty that contains the saving.

. Vermont Income Tax Forms. Federal Withholding Worksheet Retirement Office Worksheet Form. The 1099-G is a tax form for certain government payments.

Please choose from the list of forms below. IRS approved Tax1099 allows you to eFile Vermont forms online with an easy and secure filing process. We file to all states that require a state filing.

20 rows Vermont has a state income tax that ranges between 335 and 875 which is administered by. Keep in mind that some states will not update their tax forms for 2022 until January 2023. Vermont State Parks Explore our state parks and immerse yourself in the beauty of Vermont.

B-14 Employer Appeal Form. You will need to present this certificate to the vendor from whom you are making the exempt purchase - it is up to the vendor to verify that you are indeed qualified to make a tax-exempt purchase. Taxpayers may file online through myVTax or submit Form IN-151 Application for Extension of Time to File Form IN-111 by the April due date.

Use myVTax the departments online portal to e-file and submit Form PTT-172 Property Transfer Tax Return with the Department of Taxes and the municipality with a single service. The treaty article addressing the income. Below are forms for prior Tax Years starting with 2020.

To obtain a six-month extension to file the Estate Tax Return file Form EST-195 Application for Extension of Time to. Of income you must attach a statement to Form W-9 that specifies the following five items. Retiree Change of Address Form Retiree Change of Address Form.

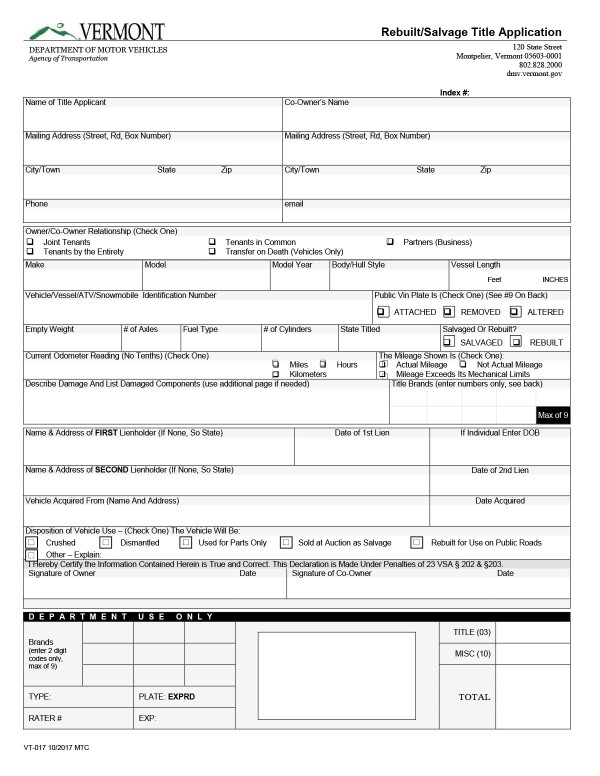

C-104 Vermont Internet Tax Wage System Upload Specifications. These back taxes forms can not longer be e-Filed. To apply for registration and title if applicable.

Includes forms VS-070 VS-071 VS-072 VS-073 VS-074 VS-075. State Withholding Worksheet Retirement Office Worksheet Form. W-2s are issued annually no later than January 31 st of the new calendar year.

Vermonters who received unemployment benefits in 2021 will need the information on the 1099-G to complete their annual income tax. Teacher Retiree Under 65 Medical Form. You dont need Form 1095-B to file federal taxes.

C-29 3rd Party Online Reporting. Designation of Beneficiary Form Designation of Beneficiary Form. You should keep your 1095-B with your tax records.

Vermont Job Link Find information for job seekers and employers on employment and training throughout the state. The current tax year is 2021 with tax returns due in April 2022. C-102 Employers Amended Quarterly Report Form.

Let us manage your state filing process. Vermont allows taxpayers an extension of six 6 months to file their Form IN-111 Vermont Individual Income Tax Return but they must submit an application first. An estate tax return on the transfer of a Vermont estate of resident and nonresident deceased persons.

This form should be filed by all Vermont residents who work in other states to avoid dual taxation on income they earned in other states. W-4P IRS Tax Withholding Form. Teacher Application To Purchase Service Credit.

Be sure to verify that the form you are downloading is for the correct year. W-4VT - Vermont Tax Withholding Form Teachers Forms. Form 1095-B is your proof of qualifying health coverage for each month you had it.

Printable Income Tax Forms. Income Tax Payment Voucher Form IN-116 Vermont Department of Taxes 211161100 DEPT USE ONLY 2021 Form IN-116 Vermont Income Tax Payment Voucher 2 1 1 1 6 1 1 0 0 Please PRINT in BLUE or BLACK INK Taxpayers Last Name First Name MI Taxpayers Social Security Number SpousesCU Partners Last Name First Name MI Spouses or CU Partners Social. Vermont State Income Tax Forms for Tax Year 2021 Jan.

C 101 Employers Quarterly Wage and Contribution Report. The Vermont income tax has four tax brackets with a maximum marginal income tax of 875 as of 2022. Used for new transactions transfers renewals title-only transactions adding or deleting an owner lease buyouts and IRP transactions.

Every January the Vermont Department of Labor sends 1099-G forms to individuals who received unemployment insurance benefits during the prior calendar year. Vermont has a state income tax that ranges between 3350 and 8750. Employment with the State of Vermont View available job openings position descriptions and apply online.

10 rows Vermont state income tax Form IN-111 must be postmarked by April 18 2022 in order to avoid. 31 2021 can be e-Filed in conjunction with a IRS Income Tax Return. Federal Withholding Worksheet Retiree Change of Address Form State Withholding Worksheet W-4P -IRS Tax Withholding Form.

If currently living outside of Vermont you must also obtain Non-Resident Reinstatement form VS-076 Town Clerk Log Sheet. VD-119-Vehicle_Registration_Tax_Titlepdf 52169 KB File Format. Generally this must be the same treaty under which you claimed exemption from tax as a nonresident alien.

W-2s are sent to the mailing address listed in your Employee Self Service. File Form E-1 if death occurs on or before Dec. A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making sales-tax-free purchases.

File Form EST-191 if death occurs on or after Jan. Without filing Schedule IN-112 such income would face dual taxation by both Vermont the state of residency and. If you file Vermont state taxes you will need to report the months that you had health coverage which you can find on your Form 1095-B.

Dental Rates Designation of Beneficiary Form. Details on how to only prepare and print a Vermont 2021 Tax Return. E-File Vermont 1099-NEC 1099-MISC 1099-B 1099-K 1099-R and W-2 directly to the Vermont State agency with Tax1099.

Detailed Vermont state income tax rates and brackets are available on this page. C-147 Employer Quarterly Wage Report Insturctions. Packet of all forms required for application for reinstatement under Total Abstinence.

Free Vermont Motor Vehicle Bill Of Sale Form Vt 005 Pdf Eforms

Virginia Tax Forms 2021 Printable State Va 760 Form And Va 760 Instructions

Tax Year 2021 Personal Income Tax Forms Department Of Taxes

2022 Tax School Education Programs Uvm Extension Cultivating Healthy Communities The University Of Vermont

Vermont Department Of Taxes Notice Of Changes Sample 1

Complete And E File Your 2021 2022 Vermont State Tax Return

California Tax Forms H R Block

Maine Tax Forms And Instructions For 2021 Form 1040me

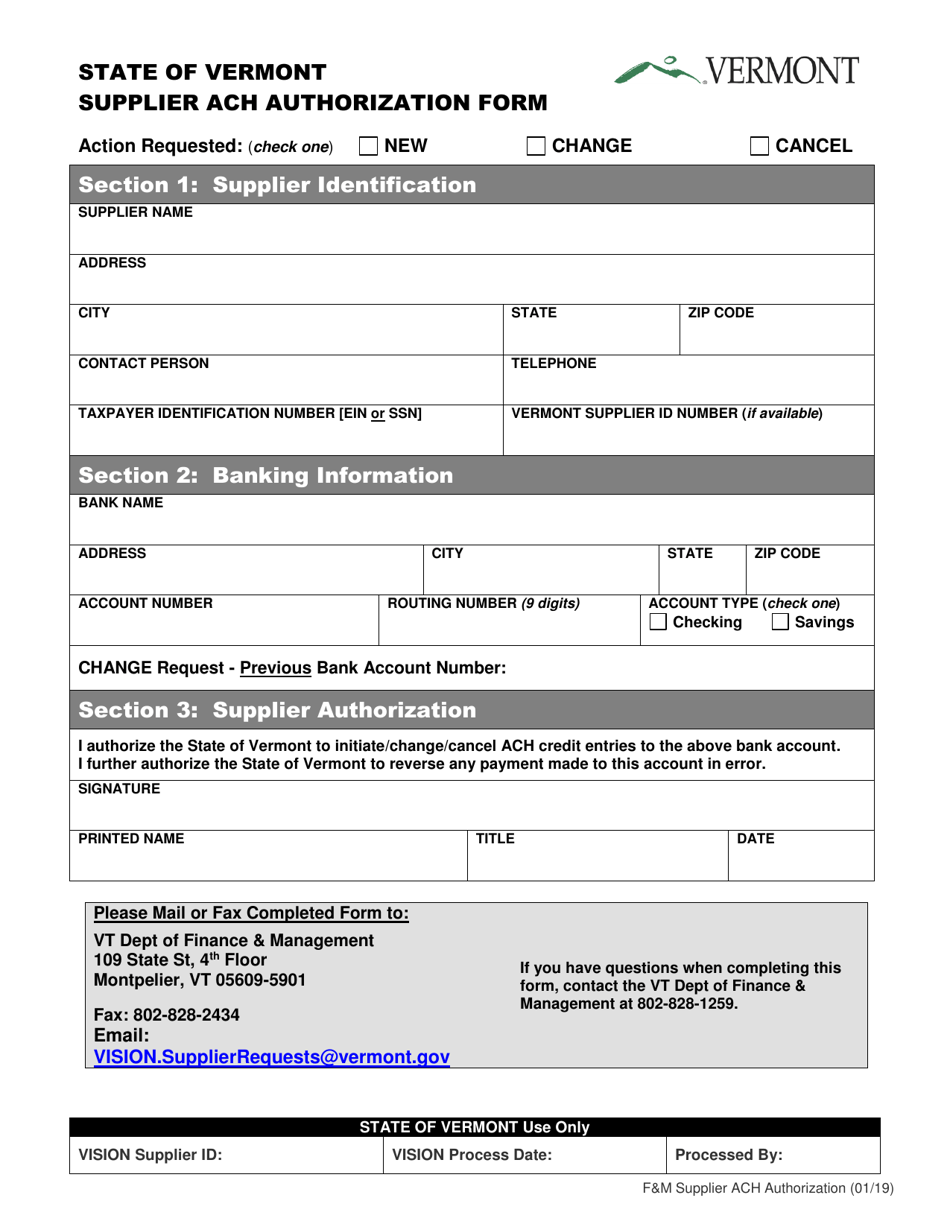

Vermont Supplier Ach Authorization Form Download Printable Pdf Templateroller

About Bills Of Sale In Vermont Key Forms Information

Publications Department Of Taxes

State W 4 Form Detailed Withholding Forms By State Chart

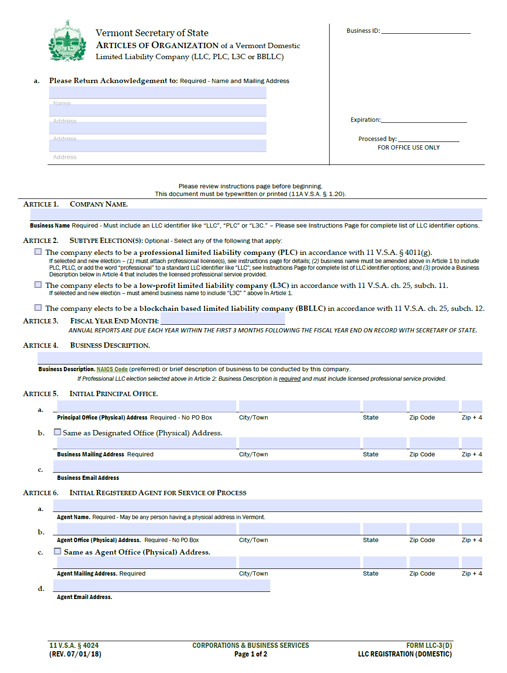

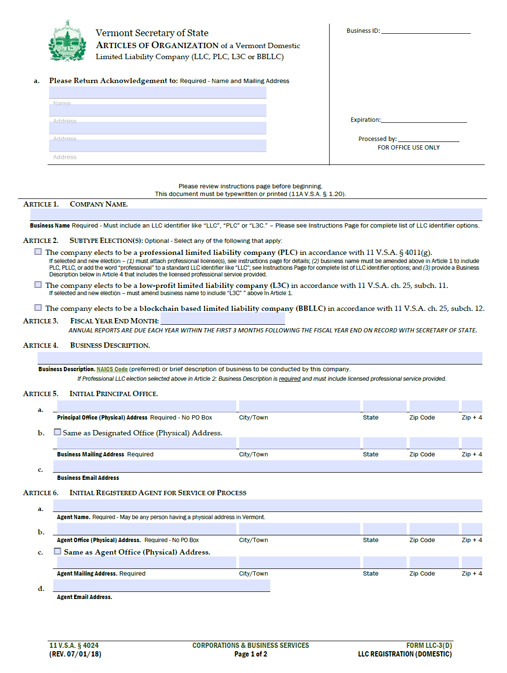

Vermont Llc How To Start An Llc In Vermont Truic

Vt Health Connect Vthealthconnect Twitter

Vermont Department Of Taxes Notice Of Changes Sample 1

Fillable Online State Vt Vermont Use Tax Return State Of Vermont State Vt Fax Email Print Pdffiller